Note: The offer for the Platinum Card has been updated. Please visit the offer landing page for the latest details.

The impact of the Coronavirus (COVID-19) has profoundly disrupted the travel industry, as well as many aspects of daily life. Many share similar frustrations about being unable to travel or even leave home for non-essential activities. However, we hope that as new COVID cases decline significantly, most loyalty programs will emerge from this crisis intact. Some companies have responded more effectively than others. A standout example is Air Canada’s innovative marketing campaign, which encourages customer engagement beyond just flying. Recently, American Express also launched two exciting promotions for their Platinum Card.

Double Points on Purchases

For the first time ever, cardholders can earn double the rewards with the American Express Platinum Card. This limited-time offer runs until July 20, 2020. Card members should have received an email titled, “Double Rewards – Enhanced Value in These Challenging Times.” There are two key highlights in this communication: all transactions will now earn double the points compared to the usual rates.

The updated earning structure for the Platinum Card is as follows:

- 3x points per dollar on dining (including food delivery)

- 2x points per dollar on eligible travel

- 1x point on all other purchases

With the doubled rewards, the new earning rates are:

- 6x points per dollar on dining

- 4x points per dollar on eligible travel

- 2x points on all other purchases

Additionally, the American Express Platinum Card is one of the few publicly available metal cards in Canada that does not require a private banking relationship. With this double rewards promotion, you can earn up to 6 Membership Rewards points per dollar spent. Membership Rewards are highly flexible and can be transferred to several airline and hotel partners, redeemed for statement credits, or used according to a fixed point redemption chart. I recommend choosing the statement credit option, as it offers great value with the current promotion.

While American Express has not officially confirmed it, readers have indicated through secure chat on the Amex site that new cardholders are eligible for this promotion. I’ve reached out to my contacts at American Express for clarification. It seems improbable that American Express would impose a limit on bonus earn rates for new accounts opened after a specific date. However, you must ensure your account is in good standing during this promotion—meaning no overdue payments.

This promotion is solely applicable to the Platinum Card and does not extend to other Membership Rewards cards like the Business Platinum Card, Business Gold Card, or Gold Rewards Card. American Express may introduce similar promotions for other cards in the future, which could make additional products very appealing.

Platinum Card Welcome Offers

Note: The offer for the Platinum Card has been updated. For the latest details, please check the offer landing page.

Public Offer: Application Link

Using Plastiq to Meet Minimum Spend

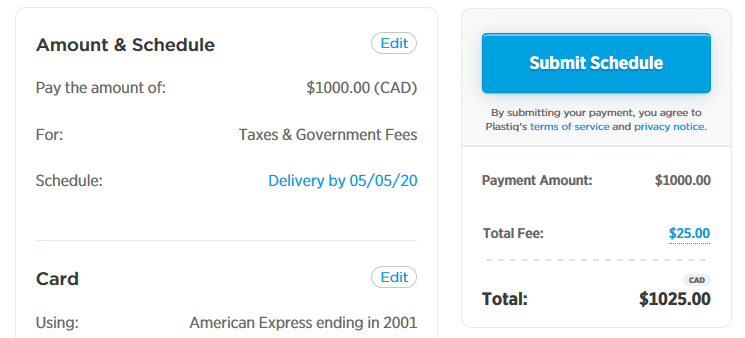

Source: Plastiq

Many have mentioned that it’s challenging to reach the minimum spend requirement right now due to limited purchasing opportunities. I recommend using Plastiq to help meet that threshold. Plastiq is a bill payment service that allows you to use your American Express card for expenses such as taxes, mortgages, and tuition—expenses typically not payable with a credit card. The company charges your card and then sends the payment to the biller electronically or by check, minimizing the merchant’s risk of fraud and chargebacks.

Plastiq – Bill Payment with a Credit Card

There is a 2.5% fee for using the service. For instance, a $1,000 payment via Plastiq incurs a fee of $25. Nonetheless, signing up allows you to get 500 fee-free dollars to offset your first payment, essentially waiving the fee on a first bill payment of up to $500. Therefore, for new customers, a $1,000 payment will only cost $12.50 in fees. If you use the American Express Platinum Card, you earn 2,000 points, equivalent to up to $40 in statement credits. This not only allows you to accrue rewards but also keeps your costs lower, ensuring you easily meet any minimum spend requirements with other credit cards.

Signup Link: Plastiq

Double Value on Rewards

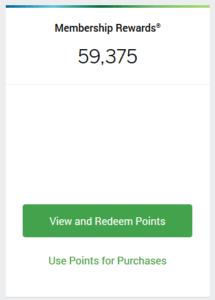

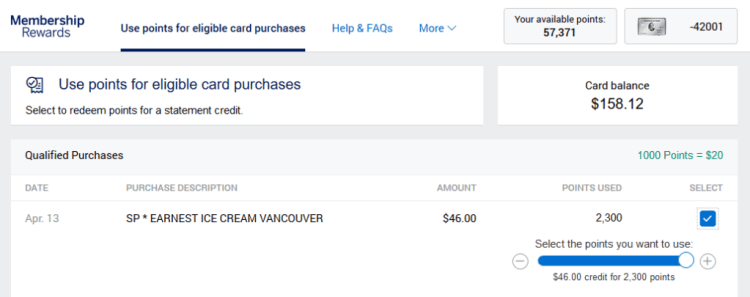

The second exciting aspect of the American Express Platinum Card promotion is that the value of points used for purchases as statement credits has now doubled. Usually, points redeemed for statement credits provide $10 for every 1,000 points redeemed. For the next three months, points will be worth $20 for each 1,000 points redeemed with the American Express Platinum Card. To take advantage of this redemption option, simply click ‘Use Points for Purchases’ in your online account dashboard.

You will see a list of previous transactions dating back 90-180 days, allowing you to select the number of points you wish to use. You can use a slider to specify how many points to redeem—you do not have to redeem all at once. For example, if I want to offset an ice cream purchase, I can use 2,300 points to generate a statement credit of $46.00.

Platinum Card – Statement Credit

Note that you are restricted to using points equivalent to your current balance. For instance, with a $200 card balance, you cannot redeem more than 10,000 points, even if you have more in your account. This means you cannot redeem points to create a credit balance for a cash refund with this promotion.

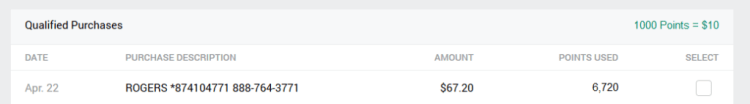

As with the double earning bonus, this promotion does not apply to any other American Express card products. If you visit the same pay with points site using another card, such as the Business Gold Rewards Card, the standard value remains at 1 cent per point (1,000 points = $10).

This promotion is exceptional and very valuable. If you use the card primarily for dining, you can earn 6 points per dollar, resulting in a 12% rebate on those purchases. For all other expenses, including groceries and other categories, the American Express Platinum Card earns 2 points per dollar, translating to a 4% rebate. This is an unprecedented offer, with no caps or restrictions on categories. The double value on your points also ends on July 20, 2020.

You can further enhance the value of your points by opening a Platinum Card and transferring any existing points from your Business Platinum or other eligible cards to the new account. This is beneficial if you plan to close an account but do not want to lose the points, as the Membership Rewards are attached to an active account. Note that points from the Cobalt card, which earns Membership Rewards Select Tier points, are not transferable in this case. Once transferred, you can redeem them at the elevated rate.

As a side note, the classic redemption option with Membership Rewards is transferring points to Aeroplan. This choice incurs an opportunity cost, as it trades away the prospect of obtaining statement credits. The cost of transferring to Aeroplan is higher than the usual 1.5 cents per mile (cpm) value I assign to Aeroplan points. Unless you plan to make a business or first-class redemption soon or assign significant value to enhancing Air Canada’s altitude status, redeeming for statement credits remains the better option.

Lufthansa First Class

Conclusion

This promotion makes the American Express Platinum Card a highly desirable option. Spending on travel and lifestyle-related purchases has dramatically decreased due to COVID-19, affecting airline, hotel, and other travel-related purchases significantly. It’s rewarding for consumers to earn and redeem points during this time, and for American Express, the promotion could help boost cash flow and interchange fees through higher purchase volumes.

We hope to see similar promotions from other card issuers, which would foster healthy competition. It would also be fantastic if American Express rolled out similar offers for their other products in the future. While such promotions may apply to other Membership Rewards charge cards, seeing one for the Marriott American Express branded cards would be particularly exciting.

Until July, the Platinum Card should be your primary choice for all spending, affirming its status as the leading premium card product in Canada.