—

Credit cards are among the most effective ways to earn rewards quickly. To qualify for the signup bonus, you typically need to meet a specified spending threshold within a set time frame, referred to as minimum spend requirements (MSR). In Canada, these requirements are generally manageable, with most credit cards asking for between $1,000 and $3,000 in spending during the first three months. Most individuals can easily meet these targets.

However, the challenge increases when the minimum spend requirements rise. In some instances, these can reach $5,000 to $10,000—amounts that are more common in the U.S. I’ve noticed that higher MSRs often come with better offers, so meeting these limits can unlock premier bonuses.

For instance, the American Express Business Platinum Card features the highest welcome bonus and minimum spend requirement in Canada. To qualify for the referral offer, you need to spend $7,000. By doing so, you can earn up to 75,000 Membership Rewards points; the public offer, in comparison, provides 50,000 points with a $5,000 minimum spend requirement.

Fortunately, there are various strategies to help you reach your spending goal. The simplest methods include prepaying bills or purchasing gift cards. These approaches allow you to accelerate your spending without adjusting your usual shopping habits. I also suggest using PayTM for service providers that do not typically accept credit cards. Engaging in Manufactured Spend adds an additional layer of complexity.

Additional Reading: PayTM Canada: Pay Bills with Your Credit Card and Earn Points!

Meeting Minimum Spend – PayPal

This post discusses PayPal, one of the easiest ways to meet your minimum spend. While straightforward, it’s a versatile and flexible option.

PayPal allows you to send money to anyone, anywhere in the world. It is also a prominent online payment processor for businesses. While many users typically transfer money using their bank accounts, you can also utilize your credit card for these transactions.

The concept involves sending money via your credit card and then having those funds returned to you—either through a bank transfer or as a direct credit card bill payment. If you’re in a group, you could create a circle where everyone uses their cards. If you need to send money to someone else, that’s even more convenient, as it eliminates the hassle of getting reimbursed.

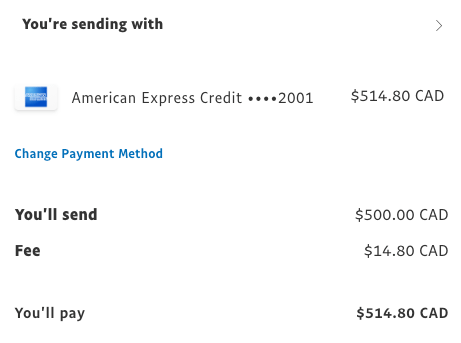

The lowest fees apply to transfers between Canadian PayPal accounts in CAD, which cost 2.9% plus $0.30 per transaction. Therefore, generating spend would incur about 2.9% in fees, which is quite reasonable for meeting minimum spend requirements.

For example, if you have a $7,000 MSR with the American Express Business Platinum Card, making seven transfers of $1,000 each would cost you 2.9% of $7,000 plus 0.30 times 7, totaling $205.10 in fees. This is significantly less than the value of the 75,000 points bonus you would earn. Additionally, you will earn 1.25 points per dollar spent, bringing your total to 83,750 points.

AMEX points transfer at a 1:1 ratio to Aeroplan and Avios. I estimate Aeroplan points value at 1.55 cents USD each; thus, the potential worth of 75,000 Membership Rewards points could exceed $1,300. Even when redeeming points for travel, the bonus still holds a value of at least $750.

Your earnings could very well be higher, as you may have regular purchases on the card as well. If you normally spend around $5,000 within three months, you would only need to find an extra $2,000. The additional cost for four $500 transfers would be under $60. Similarly, other cards with high spending requirements, like the American Express Platinum Card, would yield comparable results.

Is This Worth It?

Using PayPal for everyday purchases is not cost-effective, as you end up spending over 2 cents to earn one mile. Nevertheless, it is a viable strategy for meeting minimum spend requirements, provided the fees are lower than the value of the rewards you earn. Consider this option if you’re avoiding cards with high spending thresholds.

PayPal simplifies the process of obtaining qualifying transactions on your credit card. This can be particularly useful if you need to spend $3,000 within a mere three days. There’s no need to hunt for prepaid cards or find refundable travel items to sell or return. All it takes is a few friends willing to send money around in a circle.

Previously, there were fee-free transfer options (like Mintchip and Tilt, which are no longer operational), but those vary over time. Prepaid cards are another alternative, but they typically come with around 1% in fees. Rather than utilizing those for minimum spend, you might want to focus on maximizing the rewards you earn with the Cobalt Card.

Precautions

PayPal can be strict regarding identity verification, especially for new or inactive accounts. It’s advisable to show that your transfer is a stipend or reimbursement to a friend, which can be supported by a written agreement or equivalent. This falls well within the Terms and Conditions, and many people use PayPal specifically for this purpose.

Additionally, keep an eye on changes in your cardholder agreements. As of now, most credit cards in Canada do not categorize money transfers as ineligible transactions. After receiving your card, it’s wise to retain and read the welcome package, as it contains vital information.

Most agreements outline transactions that do not qualify for rewards, such as cash advances and interest fees. This could change, as seen in the U.S. market. Notably, American Express explicitly excludes “purchase of cash equivalents” and “person-to-person transfers” from earning rewards, and there have been crackdowns on users attempting to bypass these policies.

In conclusion, feel free to use PayPal as needed for your Canadian credit card expenses and enjoy the rewards!

—