How to Claim 70% Income Tax Exemption in Italy

Are you looking to file Module 730 and seeking information on how to claim a 70% income tax exemption? You’ve come to the right place!

Since my article on the New Tax Regime in Italy was published, I’ve received numerous thank-you emails. Many readers have shared that my insights greatly influenced their decision to relocate to Italy. After all, who wouldn’t want to pay less in taxes?

New Tax Regime in Italy

The Impatriati or Expats tax break program was first introduced by the Italian government in 2016 and later amended in 2020. This amendment allows expats to retain 70% of their salary tax-free.

For more details about eligibility and benefits, please refer to my article on the New Tax Regime in Italy.

Many expats have told me that their employers were unaware of this exemption, leading them to pay full taxes on their Busta Paga (pay slips). Don’t worry; even if your company did not apply this exemption when calculating your taxes, you can still claim it through the Agenzia Delle Entrate to receive your rightful benefits.

The steps outlined in this article are based on my personal experiences and feedback from friends who have undergone similar situations. I am not an accountant or commercialista, so please treat this as an informative guide on the claims process. Remember, each individual's situation may differ, so consulting a CAF or commercialista is advisable for specific guidance.

Before diving into the claims process, let’s first understand the overall steps involved.

What is Module 730?

In Italy, the term 730 refers to the specific module used for tax returns, which you’ll hear frequently between March and April. There are various ways to file tax returns.

You can choose to use either Module 730 or Module Persone Fisiche.

Module 730 is commonly used by every resident in Italy earning an income from employment. In contrast, Module Persone Fisiche is used solely by those who have additional income or assets to declare to the Italian government.

Your employer will provide the necessary information for filling out these modules, documented in the Certificazione Unica or CU. The income tax filed in the current year pertains to the income you earned the previous year.

The Certificazione Unica serves as a consolidated income statement (similar to Form 16 in India) from your employer. It includes details such as dependents in your family, the number of days you worked, gross salary, benefits received, and taxes paid by your employer on your behalf.

Now let’s explore how to file your income returns.

To file your tax return, you can either visit a CAF (Centro di Assistenza Fiscale) or a commercialista. The Italian government continually improves processes to make it easier for taxpayers year after year.

This year, significant improvements have been made to Module 730, allowing taxpayers to file their returns online with ease. Most information is now pre-filled in the modules, which greatly simplifies the process if no updates are required.

Steps to Complete Module 730 and Claim Your Refund

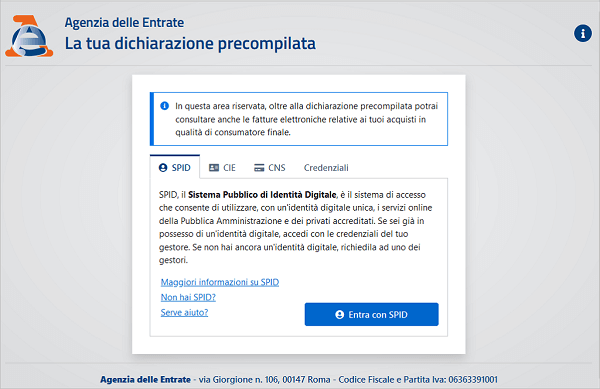

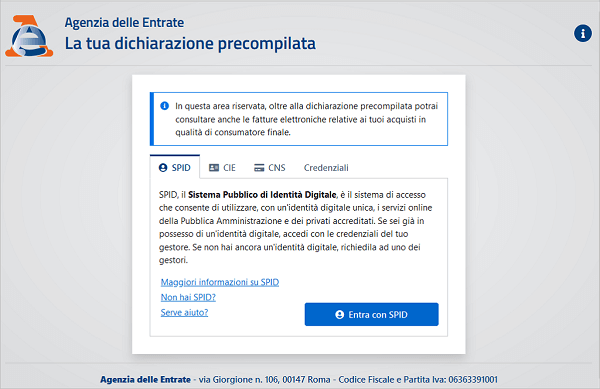

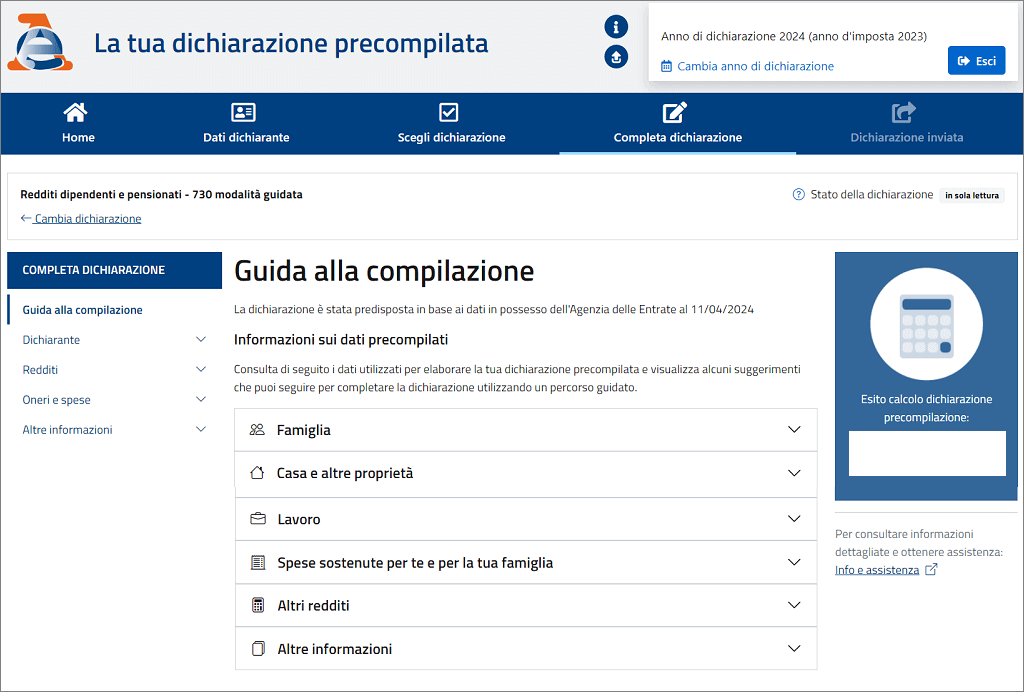

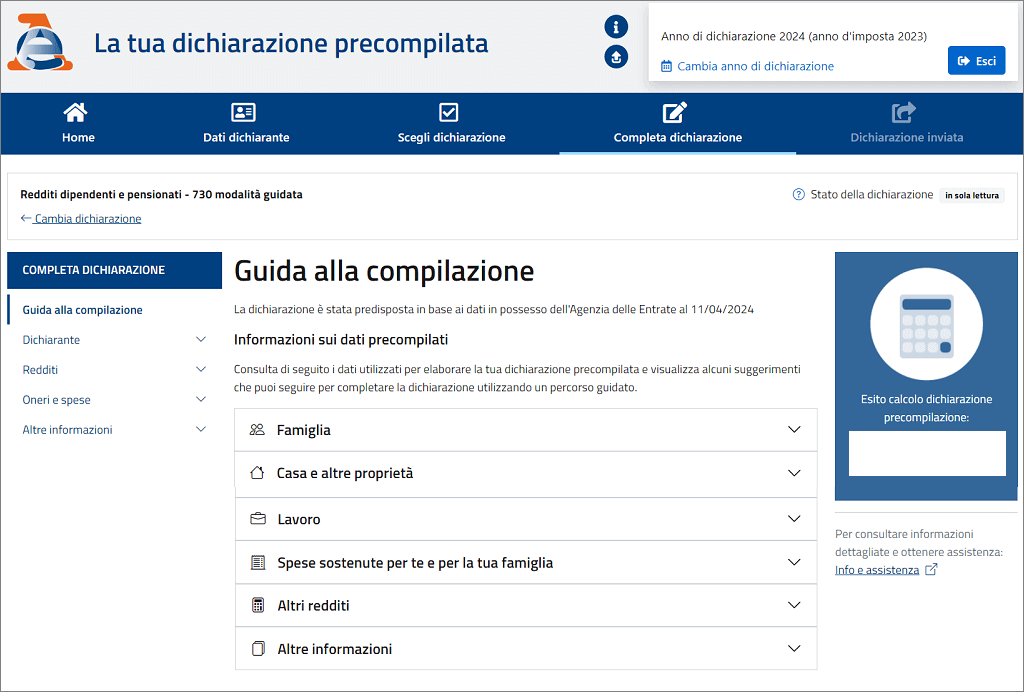

To get started, log in to the Agenzia delle Entrate portal using your SPID or CIE to access your pre-filled modules.

For more information on SPID and how to apply for one, read my article on How to Obtain Your SPID.

After logging in, you will see several options on your home screen.

Upon entry, the first priority is to ensure that the pre-filled information matches your CU and is accurate.

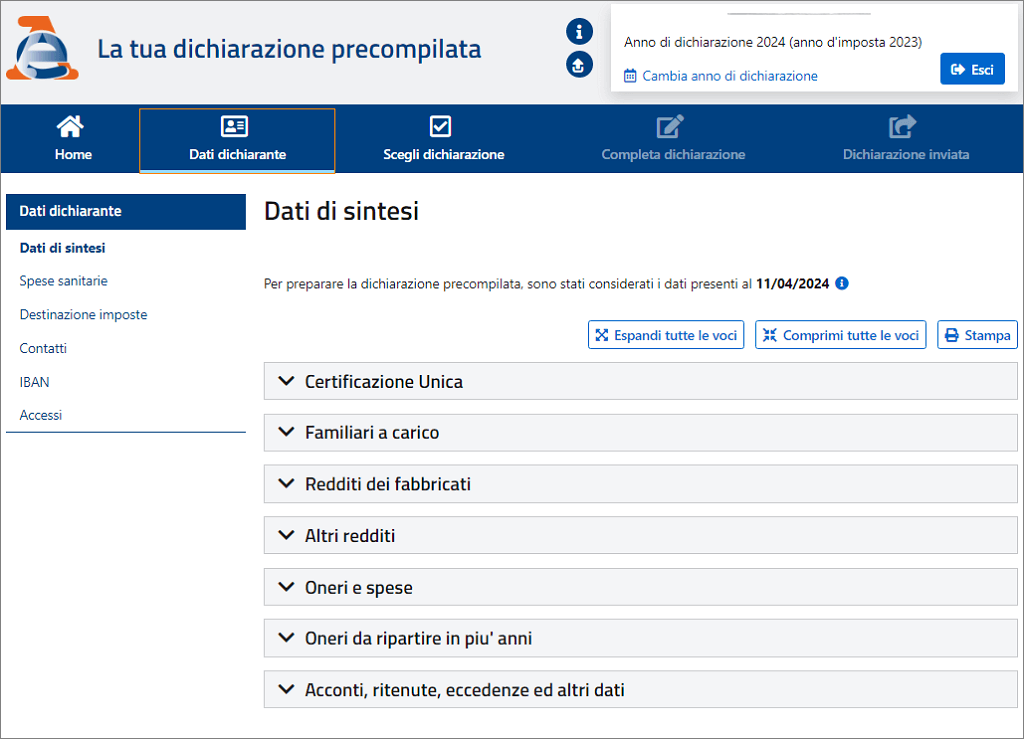

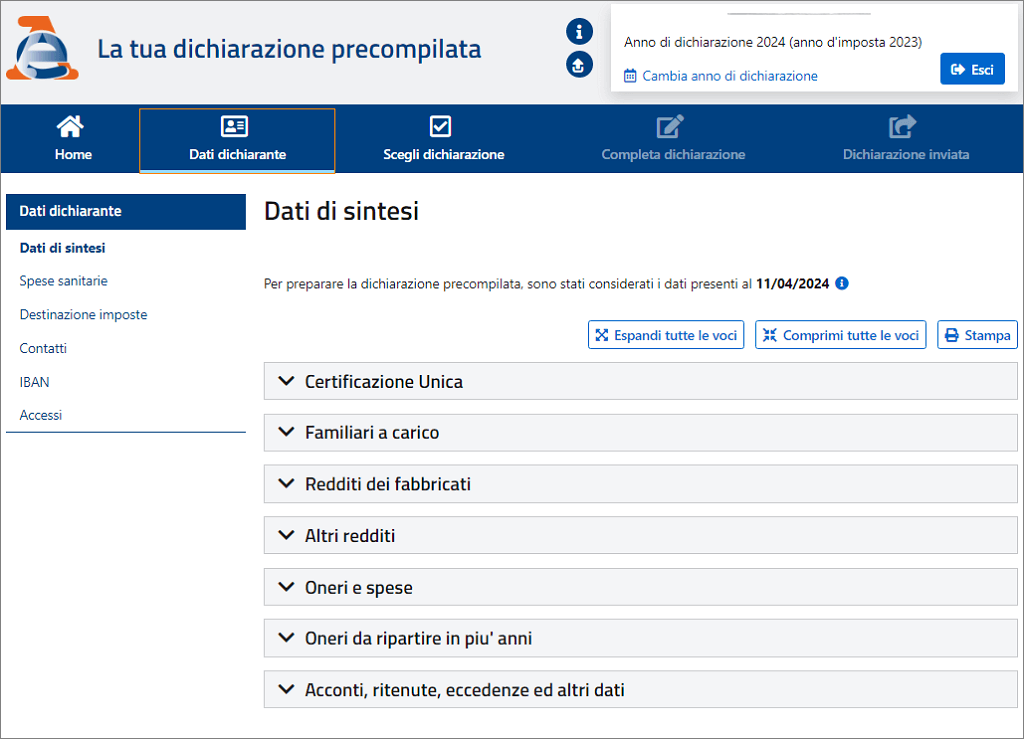

You can do this by clicking on “Dati Dichiarante,” which summarizes all your data by sections as shown below.

The “spese sanitarie” section will display payments you’ve made for medical visits and medicines for yourself and your dependents, categorized by each family member’s Codice Fiscale.

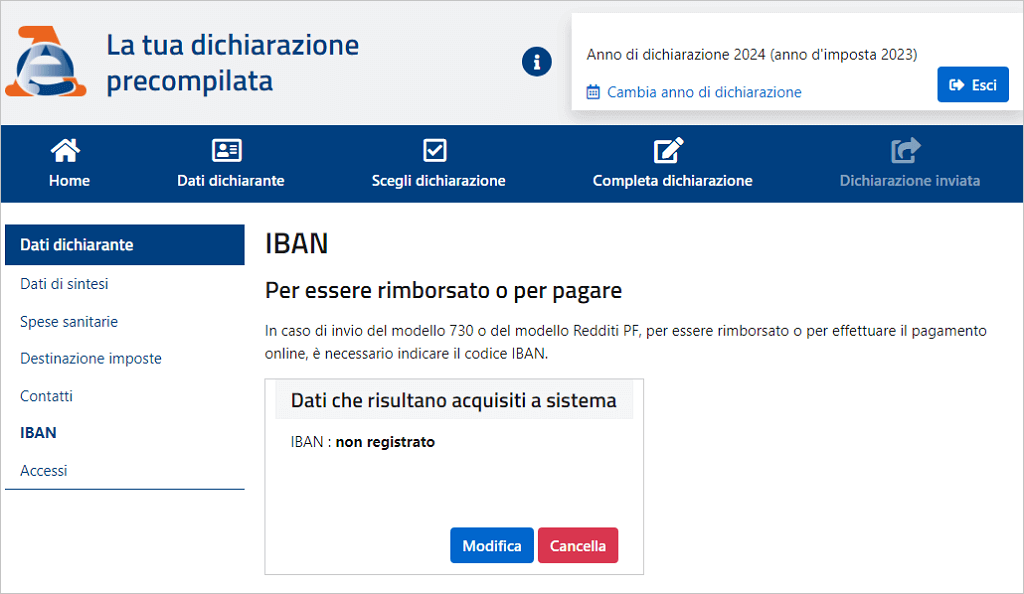

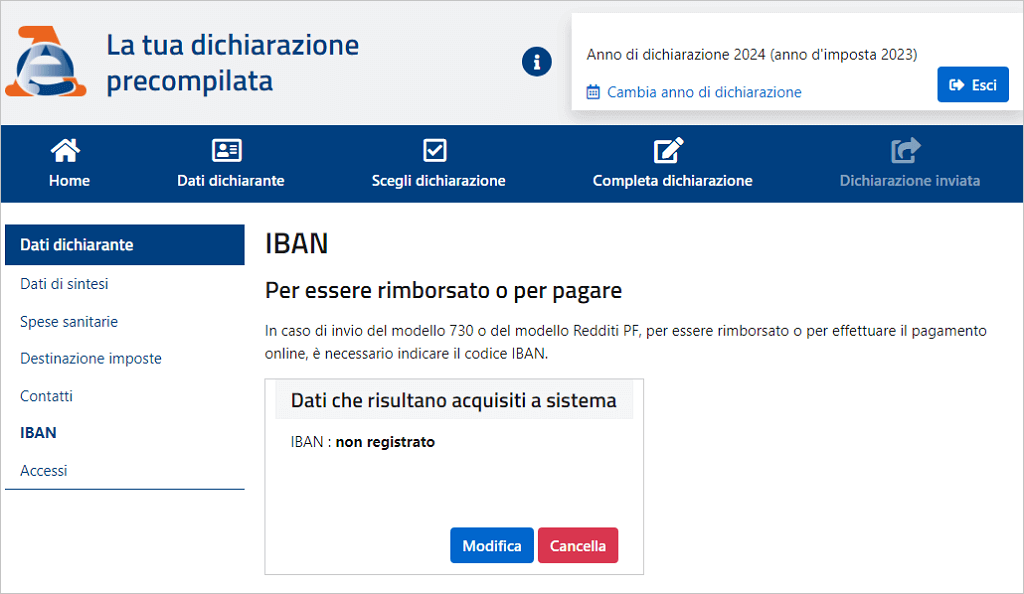

Fill in your IBAN number if you want your refund to be directly credited to your bank account.

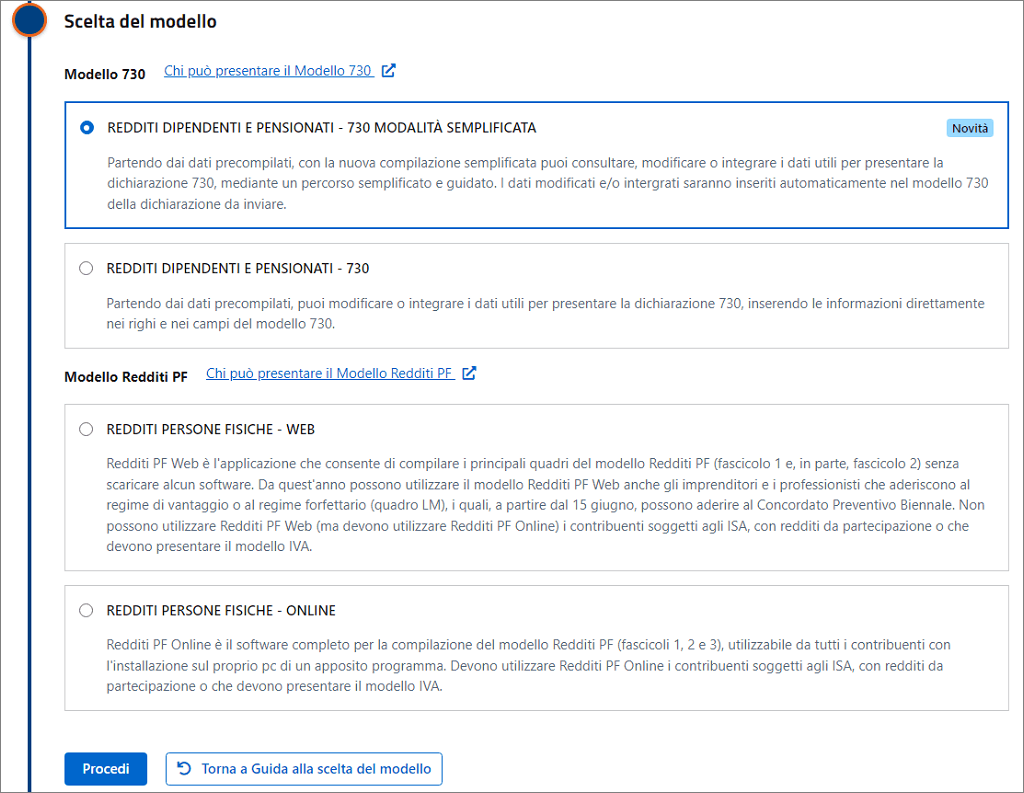

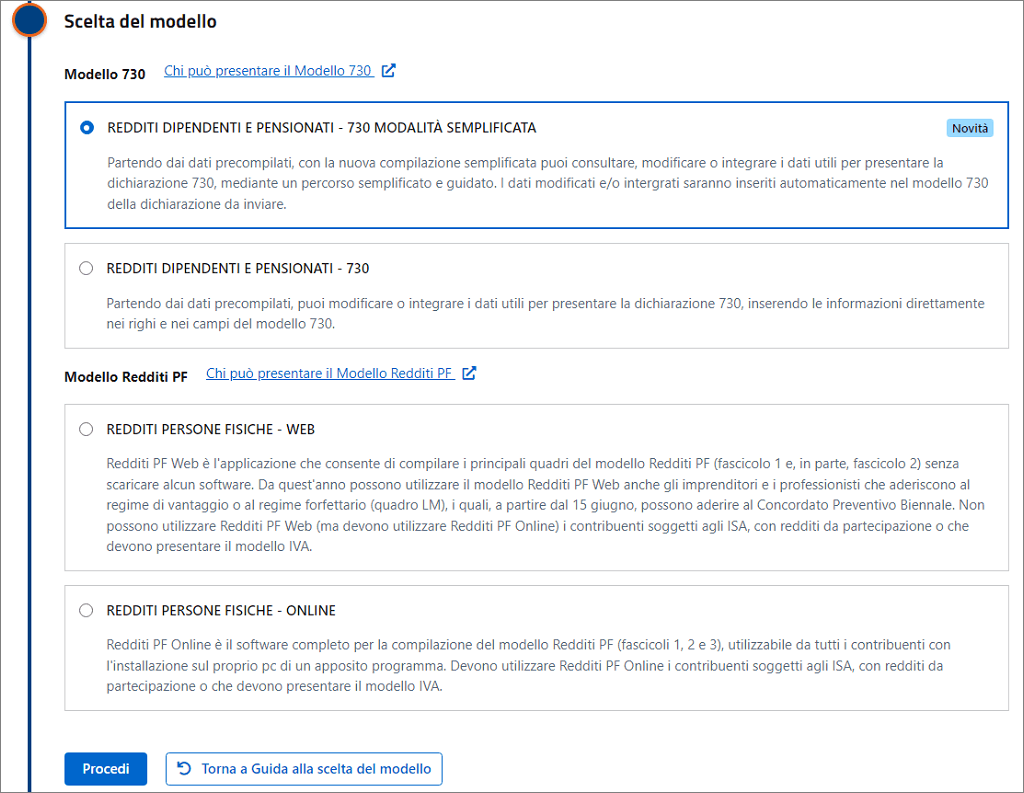

After verifying the data, you can select which form or module you want to submit.

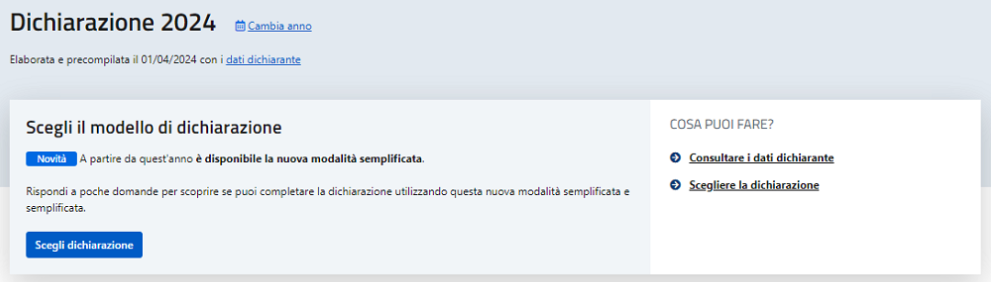

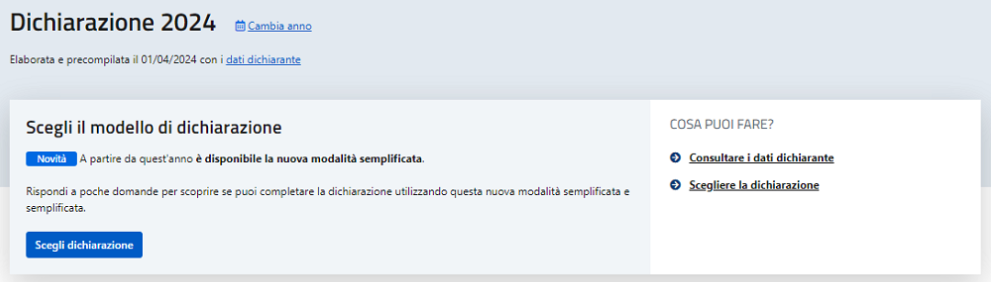

To proceed, click on “Scegli dichiarazione.” Once the selection is made, your home screen will display the selected module.

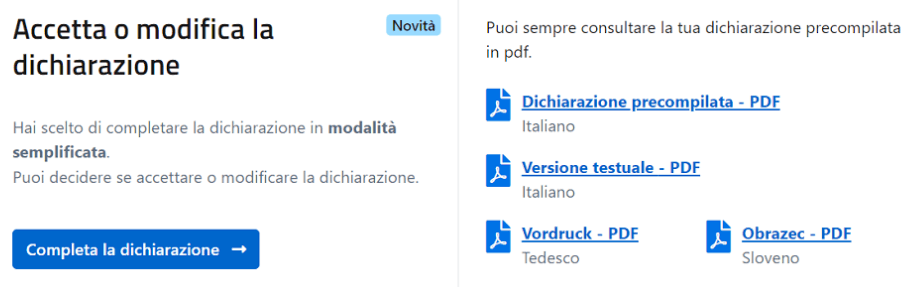

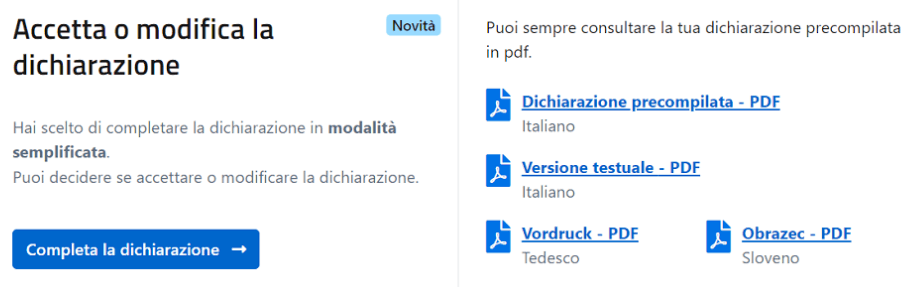

When you access this portal for the first time, you must select and accept the module on the screen shown below.

In most cases, you will only need the simplified version of the 730 module, which is listed first. It also allows you to add more modules if necessary.

If you have investments or assets outside the country, you may need to complete an additional module such as Quadro W or the RW to declare your wealth. However, to simplify things, I will cover that in a separate article.

The “Complete dichiarazione” page allows you to review all items and add or remove modules as needed.

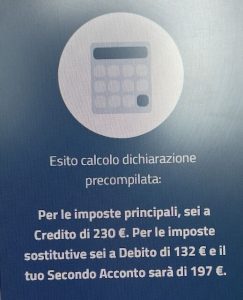

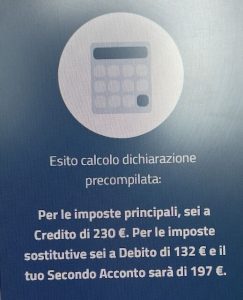

The blue window on the right side of the screen summarizes the tax amount you owe or the refund you should receive from the government. Here’s an example showing how to summarize your tax refund and any additional taxes owed.

It is important to verify the Redditi module on this page, as it contains details of your income earned in the previous year.

If you qualify for the “New Tax Regime” in Italy, you can add the Trattamento integrativo ed esenzioni module to your Redditi declaration to reclaim the extra taxes you paid under the regular tax system.

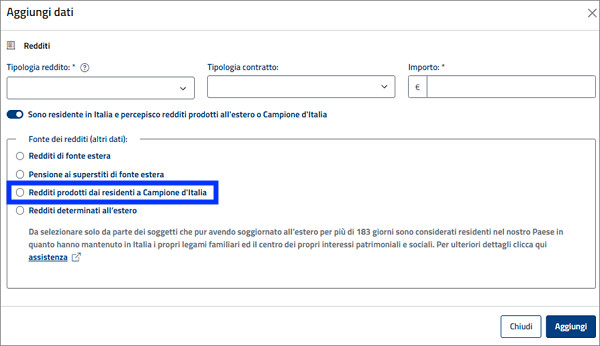

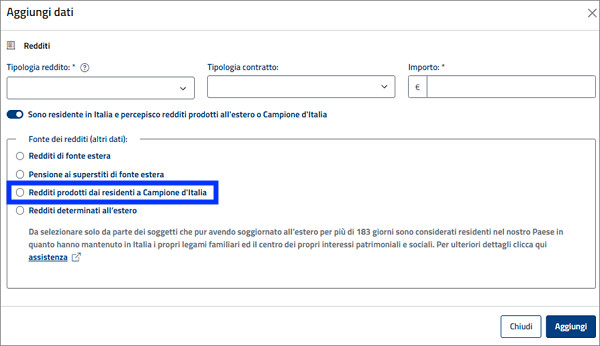

Before adding this module, ensure the pre-filled income matches your CU in the module. Normally, the “Importo” column reflects your total income from last year based on the CU. Under the “New Tax Regime,” 70% of this income is exempt from taxation.

Therefore, calculate 30% of your total income, and update it in the “Importo” column. Also, be sure to select the third option that specifies the source of the income.

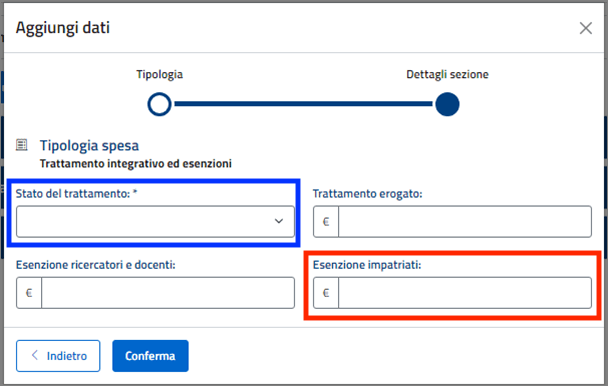

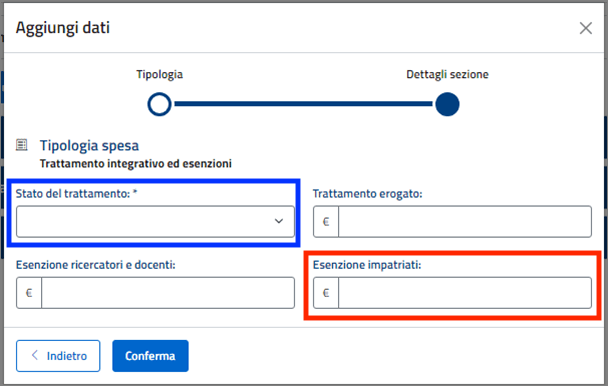

Next, add the module Trattamento integrativo ed esenzioni and fill in the details as follows:

- Select 2-Non riconosciuto dai datore di lavoro in the highlighted selection.

- Enter 70% of your total income in the Esenzione impatriati field.

Once you’ve completed this, click conferma, and you will be finished.

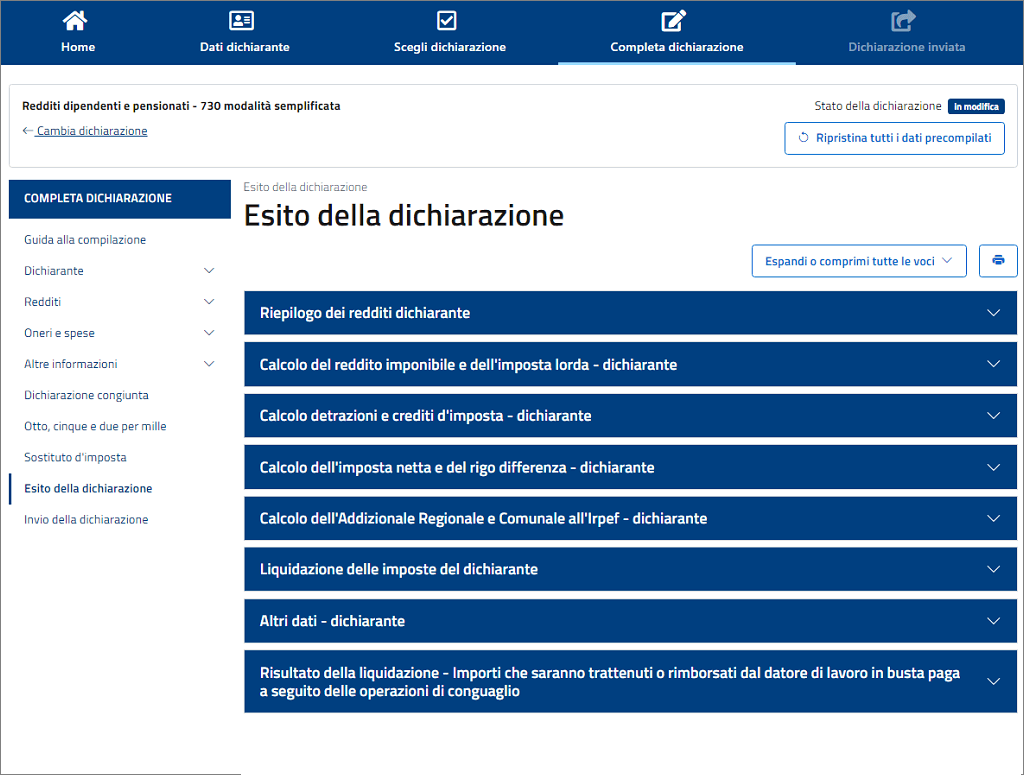

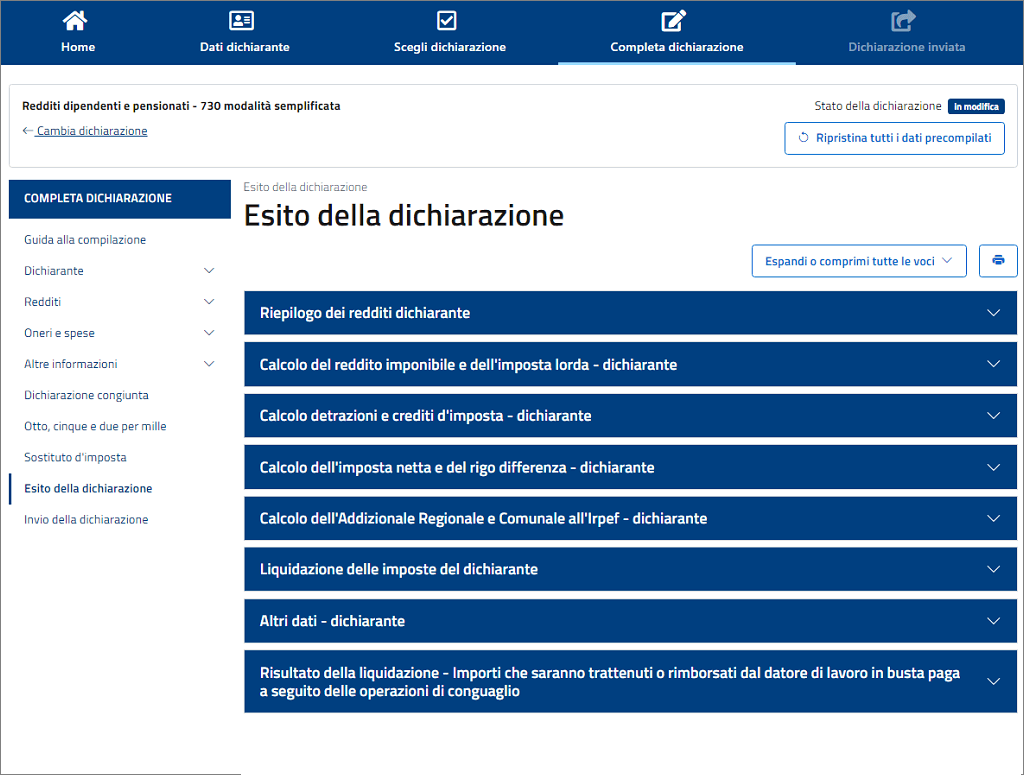

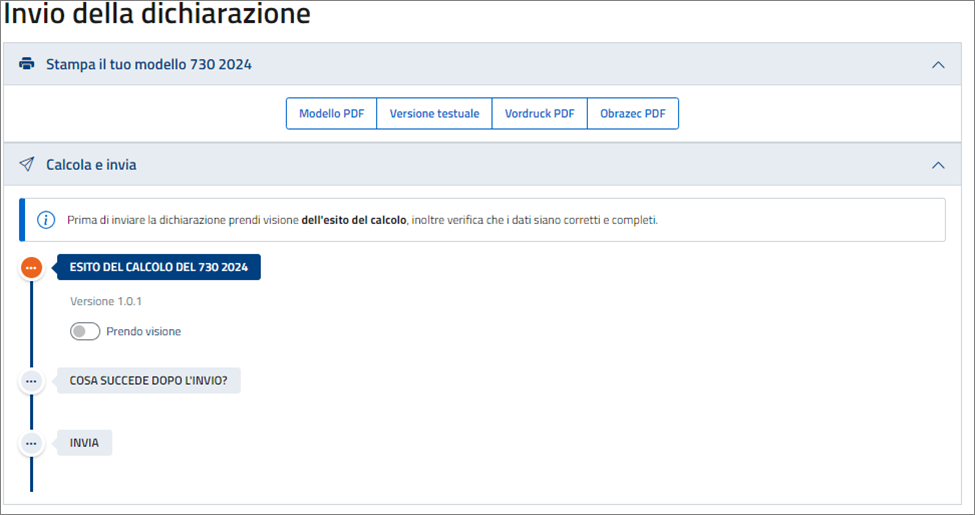

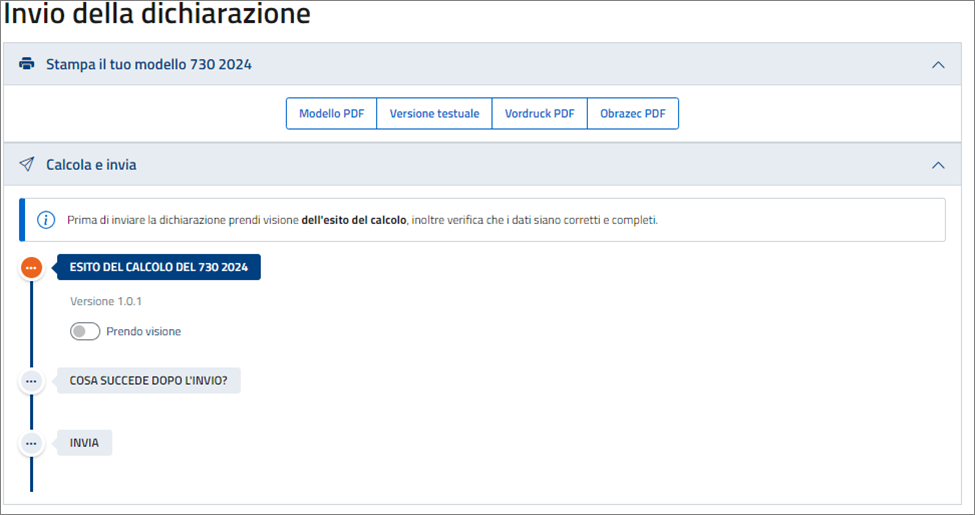

After completing these modules, you should review your information one last time under Esito della dichiarazione.

Expand each section to thoroughly review the numbers and cross-check them. You should find the updated tax calculation and the total amount of refunds that you are entitled to.

By default, your refund will be processed through your Busta Paga. If you prefer not to receive your refund via your employer and wish to have it credited to your bank account instead, you will need to provide your IBAN details.

To facilitate this, you need to complete two more fields.

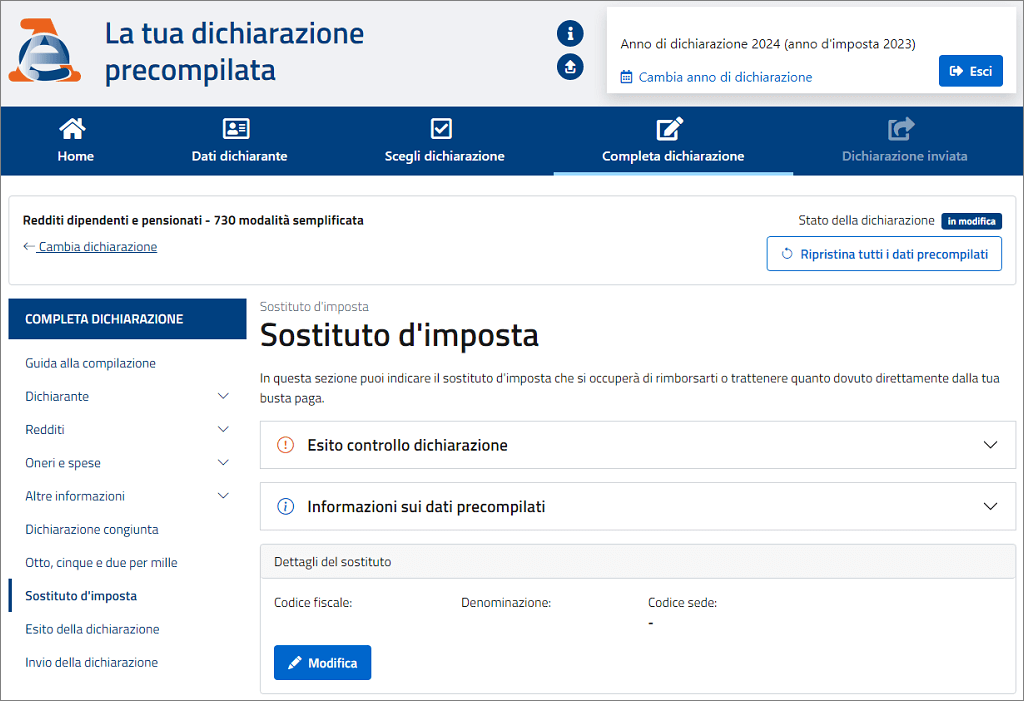

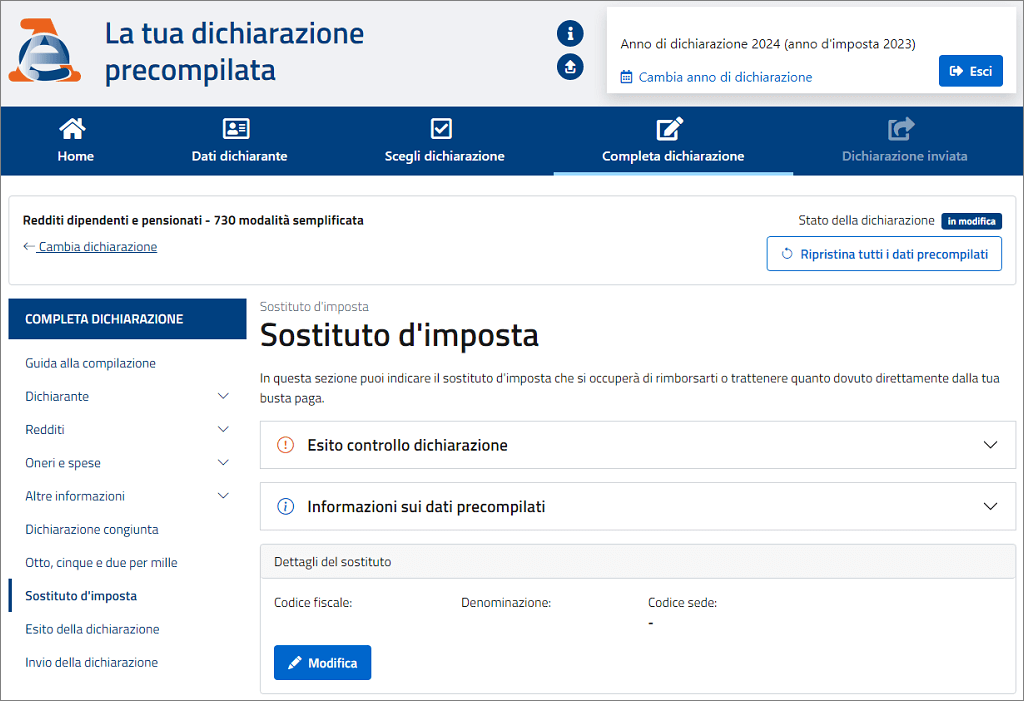

First, update the Sostituto d’imposta section in the “Completa dichiarazione” page.

Select “modifica” and choose “No.”

Next, navigate to the Dati Dichiaranti page, where you will update the IBAN section.

Finally, click on the “Invia” section. You can download the module as a PDF to review the details, and once you’re satisfied with the information, submit your application.

Congratulations!

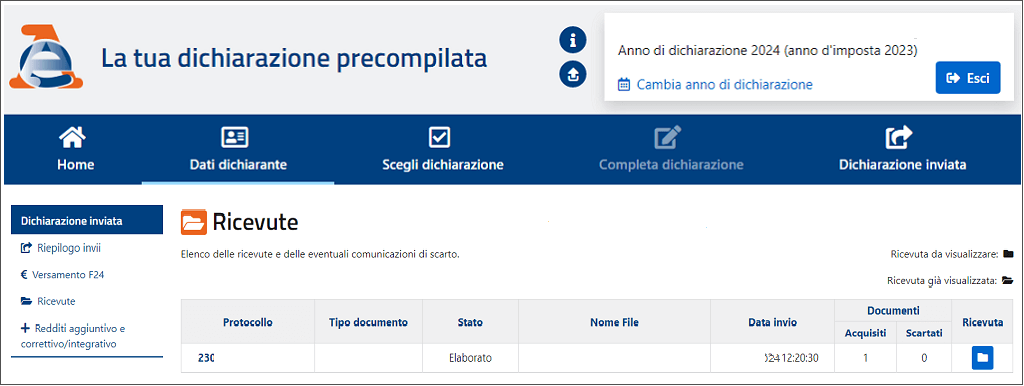

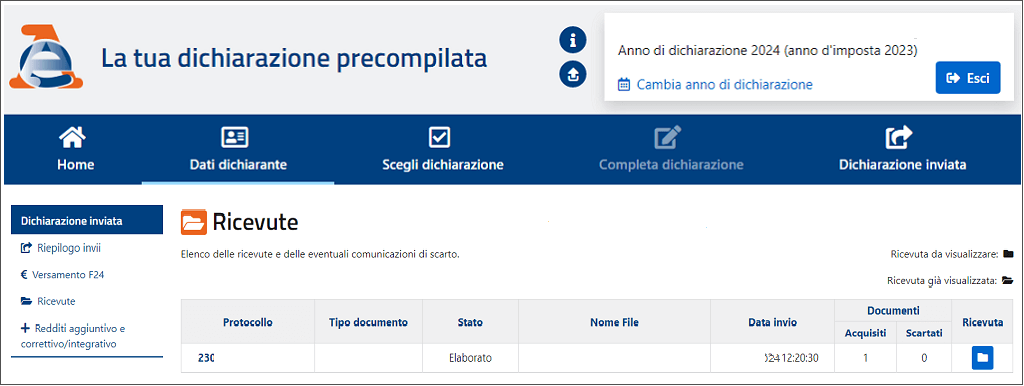

You have successfully submitted your Module 730 all on your own. To obtain the receipt, navigate to the Dati Dichiaranti page.

If you owe any additional taxes, a generated F24 will be available for your use. You can access the “Versamento F24” section to review and pay your taxes online using your IBAN.

How was your experience claiming these refunds? Did you get assistance from auditors? Please share your insights to help other readers regarding this topic.